Nursing Home Asset Protection: Can a Nursing Home Take Your House?

Can a nursing home take your house?

Many seniors and their families worry about lose their homes to pay for nursing home care. This concern is legitimate, as long term care costs continue to rise and can rapidly deplete savings. The short answer to whether a nursing home can take your house is: not straightaway, but your home may be at risk depend on your financial situation, eligibility for benefits, and planning strategies.

How nursing home costs are typically cover

Before address the specific risk to your home, it’s important to understand how nursing home care is typically finance:

-

Private pay

use personal savings and assets to cover costs -

Long term care insurance

policies specifically design to cover nursing home and other long term care expenses -

Medicare

provides limited coverage for skilled nursing care ((ypically up to 100 days )) -

Medicaid

government program that cover long term care for those who qualify financially -

Veterans benefits

programs like aid and attendance for eligible veterans and their spouses

When personal resources and insurance are insufficient, many seniors turn to Medicaid. This is where the question of homeownership become peculiarly relevant.

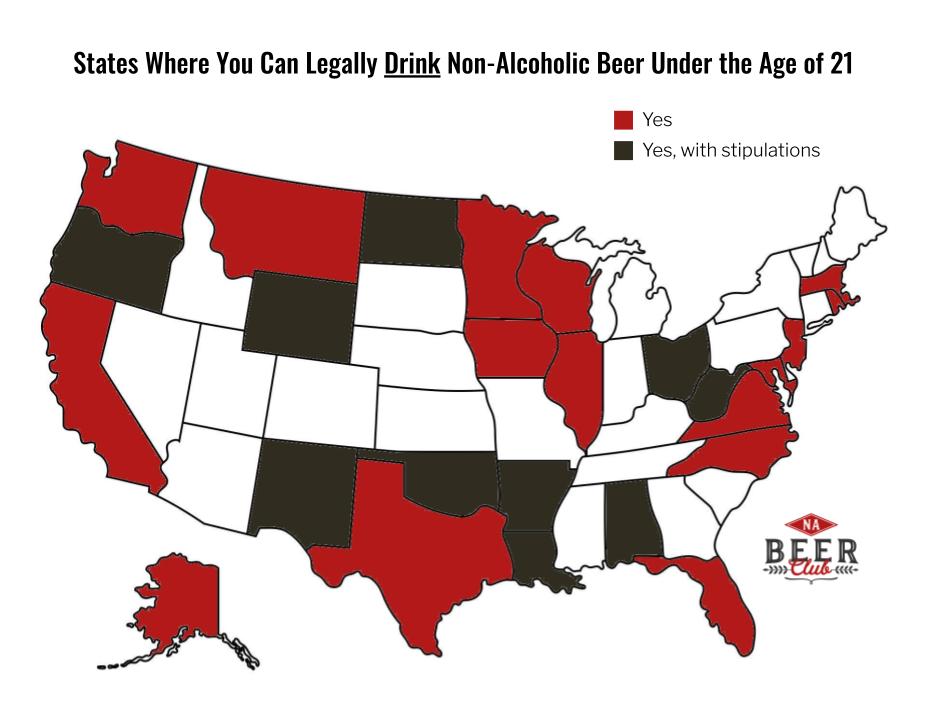

Medicaid and your home

Medicaid is the primary public program that pay for long term nursing home care, but it has strict financial eligibility requirements. To qualify, applicants must have limit income and assets.

Primary residence exemption

In most states, your primary residence is considered an exempt asset when determinMedicaidid eligibility, mean you can own a home and inactive qualify foMedicaidid. Notwithstanding, this exemption come with important limitations:

Source: asapcashoffer.com

-

Home equity limits (range from $$636000 to $ $95500, depend on the state )

) - The intent to return house (evening if unlikely )

- A spouse, dependent child, or certain other relatives live in the home

Medicaid estate recovery program (mmere)

While your home may be exempt during your lifetime, Medicaid can seek reimbursement for pay benefits after your death through the Medicaid estate recovery program. This is the primary way a nursing home stay could finally impact your homeownership.

Source: asapcashoffer.com

After a Medicaid recipient pass off, the state may place a lien on their home or make a claim against their estate to recover the costs of care provide. This mean the home might need to be sold to repay Medicaid before heirs receive their inheritance.

Exceptions to estate recovery

Several exceptions may prevent or delay Medicaid from recover against your home:

- A surviving spouse live in the home

- A child under 21 live in the home

- A blind or disabled child of any age live in the home

- A sibling with an equity interest who live in the home for at least one year before the owner enter the nursing home

- A caregiver child who live in the home for at least two years anterior to the parent enter a nursing home and provide care that delay institutionalization

- Undue hardship exemptions in certain circumstances

Protect your home from nursing home costs

With proper planning, you may be able to protect your home while ease qualify for assistance with nursing home costs. Here are several strategies to consider:

Irrevocable trusts

Transfer your home to an irrevocable trust can protect it from Medicaid estate recovery. The home is no recollective consider your asset, though you may retain the right to live thither for your lifetime. This strategy require careful timing due to Medicaid’s look back period.

Life estate

A life estate gives you the right to live in your home until death, at which point ownership transfers mechanically to the designate remainder beneficiaries. This can protect a portion of the home’s value from estate recovery, thoughMedicaidd may placid recover against the life estate interest.

Transfer to family members

Transfer your home to certain family members, such as a spouse or a child who meet specific criteria (like being your caregiver ) may protect the property. Notwithstanding, outright transfers to children who don’t meet exemption criteria could trigger the meMedicaidook back period.

Long term care insurance

Purchase long term care insurance can help cover nursing home costs, reduce or eliminate the need to rely on Medicaid and frankincense protect your home from estate recovery.

Medicaid compliant annuity

Convert countable assets into a Medicaid compliant annuity may help you qualify for Medicaid while preserve resources for a spouse or heirs.

The Medicaid look back period

A critical aspect of Medicaid planning is understood the look back period. When you apply for Medicaid, the program reviews your financial transactions for the previous five years( in most states). Any transfers of assets for less than fair market value during this period may will result in a penalty period during which mMedicaidwon’t pay for nursing home care.

This mean that give away your home or sell it for less than it’s worth within five years of apply for Medicaid could delay your eligibility. The length of the penalty depend on the value of the transfer assets and the average monthly cost of nursing home care in your state.

Spousal protections

Medicaid have special provisions to prevent spousal impoverishment when one spouse need nursing home care:

Community spouse resource allowance (cCSA))

The spouse remain at home (community spouse )can keep a certain amount of the couple’s countable assets, range from roughly $ $2924 to $ 1$1480, depend on the state.

Minimum monthly maintenance need allowance (mEmma))

The community spouse is entitled to a monthly income allowance from the institutionalized spouse’s income if their own income fall below certain thresholds.

Homeownership protection

If a home is conjointly own and the community spouse continue to live thither, the home is entirely protected during that spouse’s lifetime. Medicaid can not place a lien on the home or force its sale while the community spouse is live thither.

State variations in Medicaid rules

Medicaid is administered by states, so rule regard home protection, estate recovery, and eligibility vary importantly. Some states are more aggressive in pursue estate recovery than others. Key variations include:

- Different home equity limits

- Vary approaches to estate recovery (some states solely recover from probate estates, while others use expand definitions )

- Different implementation of hardship waivers

- Some states have filial responsibility laws that could potentially make adult children liable for parents’ care costs

Common myths about nursing homes and your home

Myth 1: nursing homes can take your house while your stillness alive

Reality: nursing homes themselves can not seize your property. They may bill you for services, and unpaid bills could lead to legal action, but they don’t have direct authority to take your home.

Myth 2: transfer your home to children directly protect it

Reality: transfer your home to children within the five-year look back period can really create a period of Medicaid ineligibility, potentially cost more than keep the home.

Myth 3: once you’re on Medicaid, your home is totally safe

Reality: while you may qualify for Medicaid while own a home, estate recovery mean the state may claim reimbursement from your estate after your death.

Myth 4: add children’s names to your deed protect the home

Reality: add children to your deed is considered a transfer of assets for less than fair market value and could trigger a look back penalty. It may too create tax complications for your children.

When should you start plan?

The best time to plan for potential nursing home costs is advantageously before you need care. Early planning provide more options and can help avoid the constraints of the five-year look back period. Consider these planning milestones:

-

In your 50s and 60s

explore long term care insurance options while premiums are more affordable -

Five or more years before anticipated need

consider asset protection strategies like trusts -

Upon diagnosis of progressive conditions

directly consult with an elder law attorney to explore available options -

Crisis planning

flush when nursing home placement is imminent or has already ooccurred some strategies may tranquilize help protect a portion of your assets

Legal assistance for protecting your home

Give the complexity of Medicaid rules and the significant financial implications, professional guidance is essential. Consider consult with:

-

Elder law attorney

specializes in issues affect seniors, include mMedicaidplanning and asset protection -

Financial advisor

can help structure assets and develop a comprehensive financial plan -

Medicaid planner

focus specifically on qualify for mMedicaidwhile preserve assets

These professionals can develop strategies tailor to your specific situation, state laws, and financial goals.

Alternative care options

Another approach to protect your home is explored care alternatives that may allow you to remain thither farseeing:

-

Home health care

receive medical services in your home -

Pace programs

programs of aall-inclusivecare for the elderly provide comprehensive medical and social services -

Assisted living

less intensive and much less expensive than nursing homes -

Adult day care

provides supervision and activities during daytime hours -

Community base Medicaid waivers

many states offer programs that provide home base services to those who would differently require nursing home care

Final considerations

Protect your home from nursing home costs require balance multiple considerations:

-

Your care need

ensure you receive appropriate care is the primary concern -

Spouse’s financial security

protect resources for a spouse who remain at home -

Legacy goals

preserve assets for heirs if important to you -

Ethical considerations

understand that mMedicaidis design as a safety net for those genuinely in need -

Time

other planning provide more options and protection

While the prospect of lose your home to pay for nursing home care is concern, with proper planning and professional guidance, you can frequently develop strategies that both ensure quality care and protect your virtually significant assets.

Conclusion

The question” can a nursing home take your house? ” dDoes’t have a simple yes or no answer. While nursing homes themselves can not flat seize your property, the cost of care and mMedicaidestate recovery can put your home at risk without proper planning.

By understand how Medicaid treat your home both during your lifetime and after death, the importance of the five-year look back period, and the various protection strategies available, you can make informed decisions that balance your care need with your desire to preserve your home for your spouse or as a legacy for your heirs.

The about important step is to consult with qualified professionals who understand the specific rules in your state and can develop a personalize plan that address your unique circumstances and goals. With proper planning, many people can both receive the care they need and protect their about valuable assets.

MORE FROM searchcritic.com