Immigration Credit Checks: Facts and Misconceptions

Do immigration authorities check credit history?

Many immigrants and visa applicants wonder if u.s. immigration authorities examine credit histories during the application process. The short answer is that u.s. citizenship and immigration services (USCIS) and other immigration agencies typically do not immediately check credit scores or run traditional credit checks during standard immigration procedures.

Nonetheless, this doesn’t mean financial information is irrelevant to immigration processes. Financial stability and history can become relevant in specific immigration contexts.

When financial information matters in immigration

Income and financial support requirements

While credit history itself isn’t routinely check, financial documentation is required in several immigration scenarios:

-

Family based immigration:

Sponsors must submit form i 864 (affidavit of support )to demonstrate they can financially support the immigrant at 125 % above the federal poverty guidelines. -

Employment based immigration:

Employers may need to prove they can pay the offer wage. -

Investment visas:

Programs like be 5 require proof of investment funds and their legitimate source. -

Student visas:

Applicants must demonstrate sufficient funds to cover education and living expenses.

These requirements focus on current financial capacity preferably than credit history. Immigration officers will want to will ensure immigrants won’t become public charges (dependent on government assistance )

Public charge determination

The” public charge ” ssessment evaluate whether an applicant is likely to become chiefly dependent on government assistance. This determination consider:

- Age, health, family status, and education

- Assets, resources, and financial status

- Employment history and skills

While credit reports aren’t explicitly require, officers may consider an applicant’s financial situation holistically. Severe financial issues might raise concerns about self-sufficiency.

Credit history and naturalization

When apply for u.s. citizenship through naturalization, applicants undergo a” good moral character ” ssessment. This evaluation doesn’t typically include credit checks, but significant financial issues could potentially affect this determination:

-

Tax compliance:

Failure to file require tax returns or pay tax debts -

Child support:

Failure to meet child support obligations -

Fraud:

Financial fraud or significant misrepresentation

Ordinary debt or modest credit problems broadly don’t impact naturalization eligibility, but substantial financial misconduct might raise character concerns.

Financial documentation for immigration applications

While credit reports themselves are seldom request, various financial documents may be required depend on the immigration pathway:

Common financial documentation

-

Tax returns:

Normally for the past 3 years -

Bank statements:

Show consistent income and financial stability -

Employment verification:

Pay stubs, employment letters, or business documentation -

Property documentation:

Deeds, mortgage statements, or rental agreements -

Asset documentation:

Investment accounts, retirement funds, or other significant assets

These documents help establish financial stability kinda than focus on credit history.

Immigration consequences of bankruptcy

Bankruptcy itself is not a barrier to immigration or naturalization. Notwithstanding, the circumstances surround bankruptcy could potentially raise issues:

- Bankruptcy result from fraudulent activities might affect moral character determinations

- Recent bankruptcy might impact a sponsor’s ability to meet income requirements for an affidavit of support

- Multiple bankruptcies might prompt additional scrutiny in certain cases

Virtually legitimate bankruptcies won’t now will affect immigration status or applications, peculiarly if they’ll occur years alone.

Building credit as an immigrant

While immigration authorities may not focus on credit history, build good credit remain important for immigrants establish lives in the United States. A positive credit history help with:

- Rent apartments or purchasing homes

- Obtain auto loans or credit cards with favorable terms

- Qualify for business loans or mortgages

- Avoid security deposits for utilities

- Sometimes evening affect employment opportunities

Strategies for building credit

Immigrants can establish credit through several methods:

-

Secured credit cards:

Require a security deposit that typically become your credit limit -

Credit builder loans:

Small loans specifically design to help establish credit -

Become an authorized user:

Being add to a family members exist credit card -

Report rent payments:

Services that report on time rent payments to credit bureaus -

Store credit cards:

Frequently easier to qualify for than major credit cards

Consistent, responsible use of these credit options can help build a positive credit history over time.

Financial red flags in immigration processes

While routine credit checks aren’t standard practice, certain financial situations might trigger additional scrutiny:

-

Significant tax delinquency:

Substantial unpaid taxes, peculiarly if there be an IRS lien -

Financial fraud convictions:

Criminal history involve financial crimes -

Unexplained large deposits:

Significant unexplained funds that raise money launder concerns -

Inconsistent financial information:

Discrepancies between report income on different applications

These issues relate more to financial integrity than credit scores themselves.

Credit history and adjustment of status

When adjust status from a temporary visa to permanent residency (green card ) financial stability become relevant through the affidavit of support requirement. Sponsors must demonstrate:

- Income at least 125 % above federal poverty guidelines for household size

- Stable employment or reliable income sources

- Ability to maintain financial support for the immigrant

While the sponsor’s credit score isn’t direct check, their overall financial capacity is evaluated through tax returns and employment documentation.

Financial requirements for specific visa categories

Investment base visas

Ex 5 and e 2 investor visas have substantial financial requirements:

- Ex 5 require a minimum investment of $800,000 to $$1050,000 depend on location

- E 2 require a” substantial ” nvestment with no fix minimum

- Both require proof of legitimate fund sources and business plans

These visas focus on investment capability quite than credit history.

Student visas

F 1 student visa applicants must demonstrate:

- Sufficient funds to cover tuition and living expenses

- Proof of financial support through bank statements, scholarships, or sponsor letters

Again, the focus is on current financial capacity sooner than credit history.

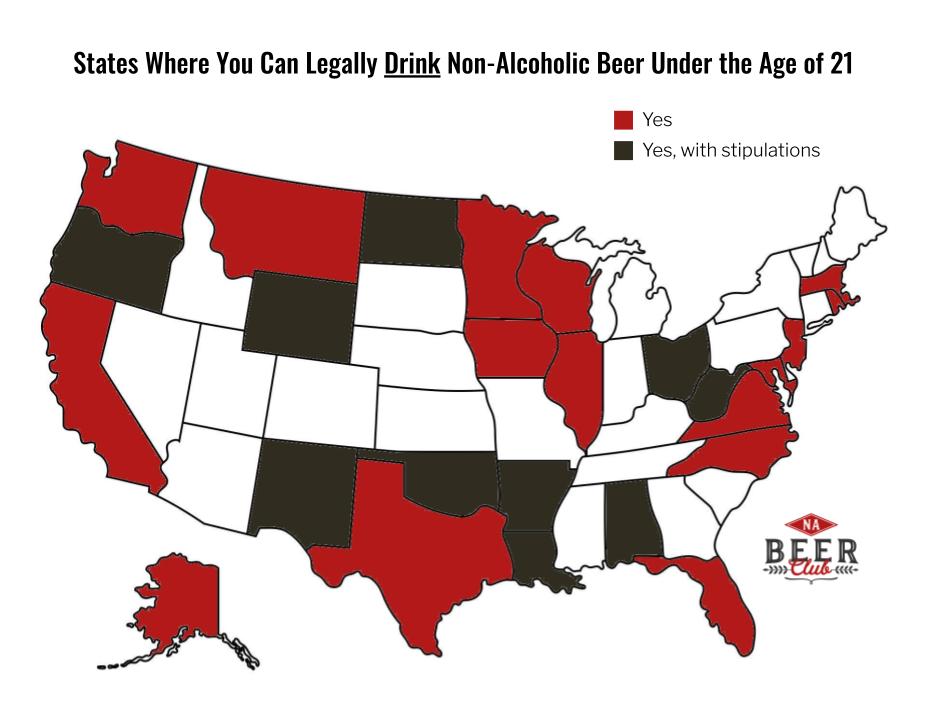

Common misconceptions about immigration and credit

Several myths persist about immigration and credit history:

Source: techcrunch.com

Myth: poor credit will result in visa denial

Reality: standard immigration processes don’t involve credit score checks. Visa decisions are base on eligibility criteria specific to each visa category, not credit scores.

Myth: immigrants start with bad credit scores

Reality: immigrants don’t start with negative credit scores. Kinda, they typically have no u.s. credit history, which mean they need to build credit from scratch.

Myth: foreign credit history transfers to the U.S.

Reality: credit histories don’t mechanically transfer between countries. Yet immigrants with excellent credit in their home countries typically start with no credit history in the U.S.

Myth: bankruptcy automatically disqualifies immigration applications

Reality: bankruptcy unequalled doesn’t disqualify immigration applicants. The circumstances surround bankruptcy might be relevant in certain cases, but legitimate financial hardship lead to bankruptcy is not an immigration barrier.

Prepare financial documentation for immigration

When prepare financial documentation for immigration applications, consider these best practices:

-

Organize chronologically:

Arrange financial records in clear chronological order -

Translate documents:

Provide certify translations for financial documents not in English -

Explain discrepancies:

Include explanatory letters for any unusual financial circumstances -

Be comprehensive:

Include all request financial documentation without gaps -

Maintain consistency:

Ensure financial information is consistent across all application materials

Thorough preparation can help avoid delays and requests for additional evidence.

When financial issues might require legal assistance

Consider consult an immigration attorney if face these financial circumstances:

- Significant tax delinquency or IRS payment plans

- Recent bankruptcy that might affect sponsorship capability

- Past financial fraud or misrepresentation issues

- Difficulty meet minimum income requirements for sponsorship

- Complex source of funds questions for investment visas

An experienced immigration attorney can provide guidance on address these potential complications.

Conclusion

U.s. immigration authorities don’t typically conduct credit checks or direct examine credit scores during standard immigration processes. Alternatively, they focus on overall financial stability, peculiarly the ability to support oneself or be support by sponsors without become dependent on government assistance.

Source: imagility.co

Financial documentation requirements vary by visa category and immigration pathway. While credit history itself isn’t commonly scrutinize, significant financial issues like tax delinquency, fraud, or inability to meet support requirements could potentially impact certain applications.

Immigrants should focus on maintain overall financial stability and compliance instead than worry specifically about credit scores in the immigration context. Nonetheless, build good credit remain important for long term financial success in the United States.

MORE FROM searchcritic.com